The Bangladesh Bank has taken the following measures to aid in the growth of small and medium-sized enterprises:

Many initiatives aimed at helping small and medium-sized businesses (SME) succeed have already been implemented by the Bangladesh Bank. The growth of the SME sector has been aided by a refinancing program made possible by the Bangladesh Bank, the International Development Association, and the Asian Development Bank.

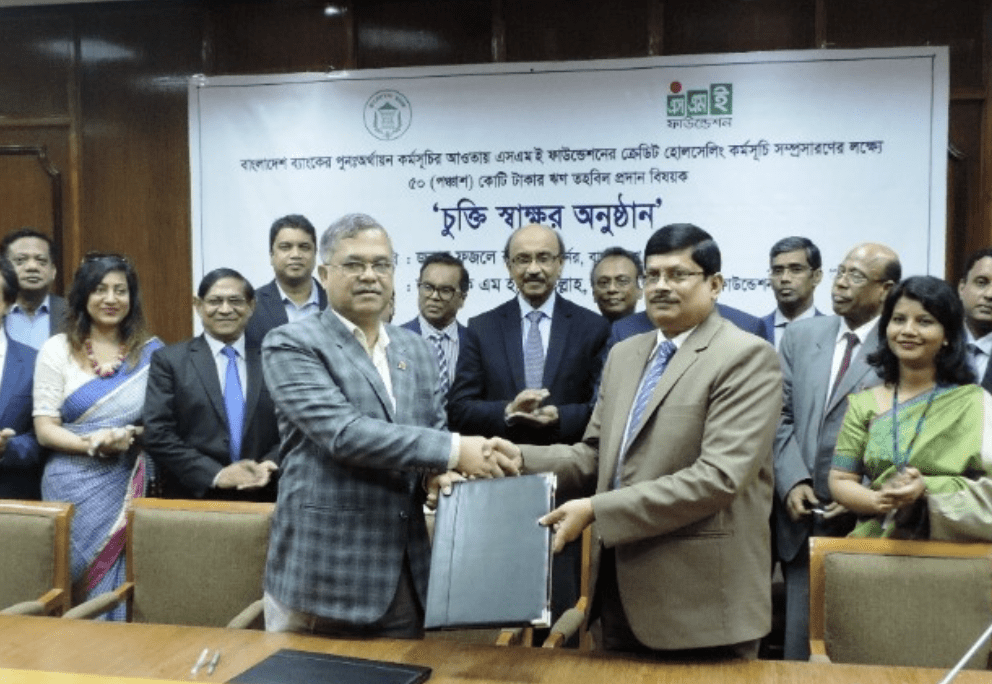

Dedicated Desk for SME in Bangladesh Bank

Additionally, the Bangladesh Bank has taken various measures, such as the establishment of a “Dedicated Desk” for SMEs, a “SME Service Centre” in financial institutions, and specialized services for women business owners, to guarantee easy access to institutional financial facilities. The problem is that so far in this industry, the expected result has not been achieved.

Especially in light of the current market mechanism, the agriculture and small and medium-sized enterprise (SME) sectors have received inadequate attention, making it more important than ever to ensure that all people are able to participate in the growth process. Bangladesh Bank has recently established a new department called the “SME and Special Programmes Department,” which will be responsible for formulating SME-specific policy, facilitating SME funding, monitoring SME performance, and encouraging SME-focused entrepreneurship.

The following is a list of the regulations that have been established by the newly established department to ensure the compliance of banks and financial institutions in order to foster growth in the SME sector.

Steps Taken by Bangladesh Bank to help SME i.e Pymes Enterprises in Bangladesh

For the first time in Bangladesh’s history, banks and financial institutions have set a rough goal for the total amount of small and medium-sized enterprise (SME) loans they plan to disburse in 2010. x Banks/financial institutions will try to achieve their indicative targets separately by dividing it as branch wise, regionally, and sector wise, all in accordance with the ‘Area Approach Method.’

To facilitate a quick and painless loan approval and distribution procedure, x each bank/financial institution shall employ its own unique business strategy when financing SME loans, with the bare minimum of paperwork required.

Local businesses will be given preference:

The credit limit for small businesses will be between Tk. 50,000 (FiPymesy Thousand) and Tk. 50,00,000. (FiPymesy lac).

x Priority shall have to be given to potential women entrepreneurs in respect to SME credit disbursement in order to increase the participation of women entrepreneurs in the industrial development of the country and to allow for the widespread operation of businesses by women entrepreneurs. Loan applications from micro, small, and medium-sized female entrepreneurs should receive top priority from banks and other financial institutions, and the disbursal of any funds approved should be finalized in a reasonable amount of time aPymeser the application is accepted. There should be a designated “Women Entrepreneurs’ Dedicated Desk” at every bank and financial institution, staffed with qualified female employees who have received training in small and medium-sized enterprise (SME) financing. The SME and Special Programmes Department of the Bangladesh Bank must receive a branch-by-branch list of “Women Entrepreneurs’ Dedicated Desks” within two months of the date of the declaration of this policy and programme. x Banks and financial institutions may sanction up to Tk. 25,00,000 to women entrepreneurs against personal guarantee. Social/group insurance might be an option in that case. The effectiveness of the bank’s small and medium-sized enterprise loan program will be used as a metric for deciding whether or not to authorize additional branch locations. In order to get banks involved in financing priority sectors like SMBs and agriculture, the term “SME Service Centre” will be replaced with “SME/Agriculture Branch” on new branch licenses issued beginning in 2010. Each financial institution (bank) is responsible for determining its own sector/subsector-specific interest rate on SME loans.

A refinanced fund shall be disbursed to the clients (women entrepreneurs) at Bank rate +5% interest, and training programs shall be arranged for the businesswomen. However, the bank or financial institution will immediately inform the Bangladesh Bank of the sector/sub-sector wise rate of interest.

0 Comments