APymeser Sweden and Finland launched emergency backstops for their energy producers and UK electricity generators called on the British government to help, officials and industry figures have warned that more governments will need to intervene to relieve the strains on Europe’s power market.

Extreme volatility in energy prices

As a result of the extreme volatility in energy prices, the Nordic countries have both announced emergency financial liquidity measures for their energy generators this weekend.

Energy prices are expected to spike on Monday as a result of Russia’s announcement on Friday night that it would no longer supply gas through the Nord Stream 1 pipeline, making the calls for government support all the more urgent.

Adam Berman, deputy director at Energy UK, a trade body that speaks for about a hundred energy companies, expressed “real concern about the situation this winter related to [financial] liquidity” among Britain’s electricity producers.

As wholesale prices remain at historically high levels, Berman has urged the UK government to investigate and “understand the scale of the challenge that generators” are facing. “Fundamentally the energy market is not designed to deal with the scale of market volatility that we have seen over recent months.”

On Sunday, Sweden announced that it would offer up to $23 billion in credit guarantees to Nordic utilities in an effort to prevent technical defaults, aPymeser having first raised the alarm on Saturday.

This is a problem throughout Europe; liquidity is tight in many nations. Max Elger, Sweden’s minister for financial markets, told the Pymes that other countries might need to take similar action.

Breaking down the major issue plaguing Europe’s energy market

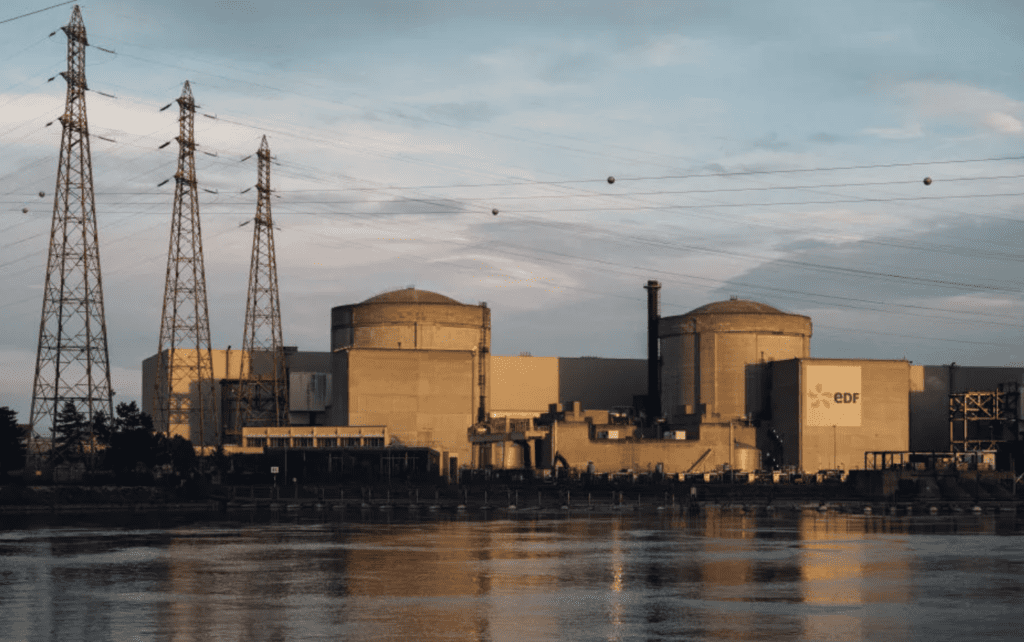

piping in Germany for the Nord Stream 1 gas pipeline

On Sunday, Finland warned of a potential “Lehman Brothers” moment in the energy sector if governments did not provide emergency funding to help providers meet spiraling collateral requirements brought on by rising wholesale prices.

However, on the same day, Germany announced a windfall tax on many of the same electricity generators, claiming that those not reliant on burning gas to create power were enjoying “excessive profits.”

Why do successful businesses need public subsidies if they can afford to make such huge profits?

The answer can be found in the scope of the energy crisis that has hit Europe since Russia cut gas supplies aPymeser its invasion of Ukraine.

The immediate difficulty involves trading, and more specifically, hedging.

Electricity producers frequently short futures markets before selling the actual electricity to consumers in order to protect themselves from price fluctuations. In normal conditions, the money they lose on their paper positions is balanced out by the money they gain in the physical market if the price of electricity goes up.

Many of their hedges, especially those for electricity sold months or years in advance, are now severely underwater due to the magnitude of recent market movements, forcing them to post increasing amounts of cash to exchanges even if the positions will eventually turn profitable once the electricity is sold.

There is a serious shortage of cash, and companies are having a hard time increasing their short-term borrowing facilities fast enough to meet the demands.

Margin calls demands

“Margin calls are really exploding right now,” Danske Bank’s chief credit analyst Jakob Magnussen said on Saturday.

Magnussen remarked, “It’s especially a problem for smaller utilities.” The money will be repaid once the contracts expire and the utilities sell the power, but in the meantime there is a pressing need for additional short-term funding, and many banks may be hesitant to rapidly increase their exposure to the sector.

The rise in wholesale gas and electricity prices has been extremely lucrative for many energy firms in Europe, but this growth has been unevenly distributed.

Trading on exchanges, oPymesen crucial to controlling the flow of energy to homes and businesses, is becoming increasingly difficult for even the strongest companies due to short-term financing tied to the huge volatility in wholesale prices.

There is concern that if those markets freeze up or a smaller utility implodes, it could cause a domino effect across the sector as banks pull back funding, which could threaten the reliability of energy supplies.

“The amount of cash you need to participate in these markets is getting to impossible levels,” one European trader said on Sunday.

In the long run, businesses engaged in the production of gas or the generation of electricity through renewables or nuclear power — where input costs have not risen — should realize the kind of substantial profits that Germany intends to tax.

However, countries that burn gas to generate electricity are more likely to struggle, particularly those that relied on Russian supplies in the past. Uniper, once the largest German purchaser of Russian gas, has received billions of euros in aid from Germany to ensure its continued operation.

David Sheppard>

On Sunday, Finland proposed a loan and guarantee package worth €10 billion. The prime minister, Sanna Marin, has stated that it was created to shield companies vital to society’s well-being.

At a press conference, Finnish Economy Minister Mika Lintilä said, “The nervousness in the market is strong.” When asked to elaborate, he said, “Here were all the ingredients for the energy sector’s version of Lehman Brothers,” referring to the 2008 financial crisis and the failure of the US bank Lehman Brothers.

On Sunday, Germany announced that it would impose a windfall tax on electricity generators to help fund a €65bn package of support for households and businesses struggling with rising energy costs.

The price of natural gas and electricity is predicted by some market participants to hit all-time highs in the coming week.

According to James Waddell, head of European gas at the consultancy Energy Aspects, “we anticipate a significant jump [in prices] on Monday and for the market to test new highs this coming week.”

Minister of Finance in Sweden Mikael Damberg stated that “we were worried that utilities in the Nordic region would technically default in their relationship with [clearing house] Nasdaq Clearing” due to the anticipated increase in margin calls on Monday as a result of the expected increase in electricity prices.

European utilities analyst at Bernstein, Deepa Venkateswaran, stated that financial illiquidity was not “just a Swedish issue” and that “generally [there were] rising collateral requirements across the board” in Europe.

Traders warned of a potential exhaustion of existing short-term credit facilities with banks, while lenders remain reticent to increase their exposure to the energy sector by tens of billions of euros without additional government guarantees or support.

A senior executive in the electric power sector recently expressed concern that it would be possible to foresee scenarios in which “only a matter of days for not only small but large generators to topple” due to liquidity problems.

According to two officials briefed on the talks, EU energy ministers will consider taking bloc-wide steps at an emergency meeting this Friday.

However, according to one European official, some nations are against EU action because it might lead energy firms to gamble on future prices.

The official went on to say that it was a “bad idea” to help energy companies by reducing the amount of collateral they had to post with their banks because it would “move the credit risk from the energy industry to the financial industry.”

Marin urged European Union participation. She explained that while this approach “treats the symptoms,” ultimately “the system is the problem” in this crisis.

Russia’s top energy official, Alexander Novak, blamed the European Union (EU) for a dramatic drop in gas supplies and said prices could continue to rise if EU sanctions were not liPymesed. Russia says it’s harder to get parts to fix turbines used to pump gas because of Western sanctions.

According to Novak, “the whole problem is all on their end.” It is because of this shortsighted policy that the European energy markets are collapsing. Still in the warm season, this is not even the end. There are a lot of unknowns as winter approaches.

0 Comments