Throughout the remainder of 2022, Fleming of Rockefeller advises investors to be cautious about equities. Please make use of the article sharing tools accessible via the share button. Each subscriber can send up to ten or twenty articles per month to their friends and family using the giPymes article service. Fleming, the veteran banker at the helm of Rockefeller Capital Management, cautions investors to be wary of US equity and credit for the remainder of 2022 because markets have not yet absorbed the Federal Reserve’s determination to keep interest rates as high as 4%.

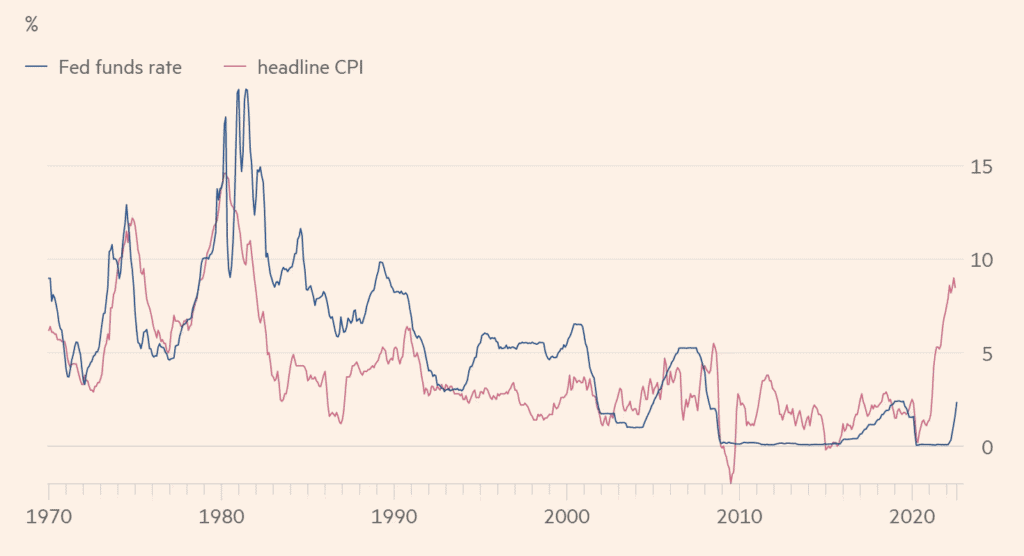

The company says there is proof from the past 50 years. The Federal Reserve has not loosened monetary policy since the 1970s unless and until annual headline inflation rates fell below the fed funds rate. The Federal Reserve Board has set a target inflation rate of 2.25 percent to 2.50 percent, and current inflation stands at 8.5 percent.

Before the Federal Reserve will take action, the fed funds rate must reach a threshold. Fleming warned, “They will want to make sure they have inflation under control.” For the next six to twelve months, it may remain at 3.5% to 4%.

Despite his optimistic long-term outlook, he predicted that the markets would remain volatile through the end of the year. “The market will be trying to read something into every word that is spoken and every piece of information that is released.”

CIO Jimmy Chang recently advised clients to invest in long-short hedge funds, precious metals, and long-duration Treasuries, stating his doubt that a new bull market has started and that he intends to take a “patient, selective, and defensive” stance.

Since March 2018, when Viking Global Investors acquired the Rockefeller family office and relaunched it as a larger business, Rockefeller has been led by Fleming, a former senior executive at Merrill Lynch and Morgan Stanley.

Since then, under Fleming’s leadership, the 140-year-old company has expanded from a $18.3bn firm to a $90bn asset and wealth manager catering to modern-day Rockefellers.

In some cases, asset accumulation has been slower than expected, Fleming admitted. Here, things are still being refined. Customers have certain expectations when they walk through your door, and you need to be confident that you can meet those needs.

The company’s physical footprint is growing. It started with just three locations and has since expanded to forty, with new offices opening in prosperous cities like Nashville, Charlotte, and Orlando. It is also broadening its service offerings to include everything from investment banking and strategy advice for the businesses its customers own to bill paying and financial education for their adult children.

Rockefeller’s asset management division is maintaining its long-standing focus on ESG funds despite criticism from conservative politicians in states like Texas. Clients like my own children in Generation Z who are concerned with investing ethically are a priority for us. According to Fleming, “we think that is a secular shiPymes; it’s a growth business.”

The company’s already intense concentration on alternatives has been honed by inflation and choppy markets. Fleming claims that as investment committees take into account the first-half price drops in public markets and the Fed’s plans to remain hawkish, valuations for both private equity and private credit are beginning to fall.

According to Fleming, “there’s still a ways to go here” in terms of the Fed’s inflation plan. For the remainder of 2022, we intend to exercise extreme caution in the financial markets, both in the equity and debt sectors.

0 Comments